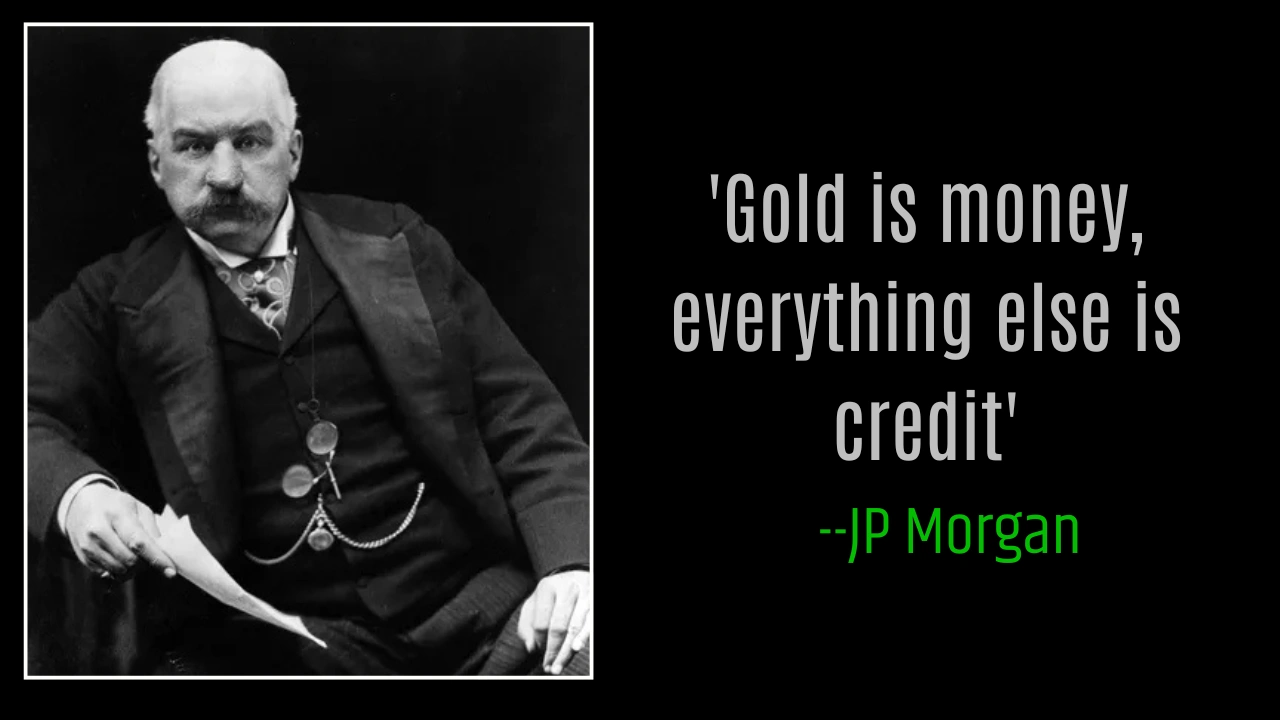

The quote of the day by JP Morgan offers a direct and bold message about the nature of money and value. The quote, “Gold is money. Everything else is credit,” continues to capture the attention of investors, economists, and readers worldwide. In a world where most people rely on digital transactions and fiat currency, this powerful statement makes us pause and think about what truly holds value.

This article uncovers the meaning of the quote, its continued relevance in today’s financial systems, and why J.P. Morgan’s legacy still matters. We’ll also look at how his ideas influenced global markets, explore his early life, and share some of his most memorable quotes. Whether you are into finance or simply curious about history, the quote of the day by JP Morgan carries lessons worth exploring.

Quote of the day by JP Morgan and its meaning

When J.P. Morgan said, “Gold is money. Everything else is credit,” he was not making a casual statement. He was describing the backbone of financial systems that existed long before digital banking and credit cards. Gold, in his view, was not just a commodity. It was the standard. It had physical weight, global recognition, and did not require trust to function as money.

Credit, on the other hand, depends entirely on belief. It is a promise that the borrower will repay. This form of value has no meaning without trust. Banks lend money based on this very principle. The quote makes it clear that while credit can be created and erased, gold remains constant.

Overview of the Quote of the Day by JP Morgan

| Element | Details |

| Main Quote | “Gold is money. Everything else is credit.” |

| Meaning | Gold has inherent value. Credit is trust-based and conditional. |

| Why it matters today | Reflects concerns about inflation, trust in currencies, and debt systems. |

| J.P. Morgan | American financier and banker who shaped US and global financial systems. |

| Born / Died | April 17, 1837 – March 31, 1913 |

| Major Contributions | Banking reform, railroad organization, corporate mergers. |

| Famous Companies Involved | U.S. Steel, General Electric, International Harvester. |

| Cultural Legacy | Art collector, Morgan Library and Museum, timeless quotes. |

Who was J.P. Morgan

J.P. Morgan was born in Hartford, Connecticut, in 1837. He came from a family deeply involved in finance. His father, Junius Spencer Morgan, was already an established banker. This environment shaped young Morgan’s view of money, trust, and value from an early age. He studied both in the United States and in Europe, including the University of Göttingen in Germany.

Morgan began his career in 1857 as an accountant in New York. He quickly climbed the financial ladder, gaining recognition for his analytical thinking and sharp decisions. By the 1870s, he became a key figure in banking and investment. His reputation was built not only on his wealth but also on his ability to stabilize industries in times of financial panic.

Building the banking empire

Morgan co-founded Drexel, Morgan and Company in 1871. This firm eventually became J.P. Morgan and Company, one of the most powerful financial institutions in the world. His influence extended far beyond the United States. He provided financing for both governments and global corporations.

By the 1890s, Morgan was already helping fund the U.S. Treasury and directing massive capital flows. He wasn’t just making profits. He was guiding the structure of modern capitalism. The quote of the day by JP Morgan fits perfectly with his approach. He focused on real value and avoided speculation based solely on promises.

Influence on railroads and American industry

Morgan played a huge role in reshaping the railroad system in the United States. At a time when competition was fierce and finances were unstable, he stepped in to reorganize railroads and reduce conflict between companies. His actions brought stability and renewed investor trust.

He was also involved in forming companies that would dominate American industry. He backed the creation of General Electric and United States Steel. The latter became the world’s first billion-dollar company. Through these efforts, he showed a deep understanding of value creation and long-term planning.

Crisis management and restoring trust

Two major financial events put Morgan’s leadership to the test. In the Panic of 1893, the U.S. gold reserves were at risk. Morgan stepped in and provided $62 million in gold to help the government. His ability to act fast and think clearly helped prevent further damage to the economy.

Again in 1907, when panic spread through the banking system, it was Morgan who brought together major financial players to avoid a full-blown collapse. He used both his resources and his reputation to restore calm. These actions make it clear why his quote about gold and credit continues to be repeated. He lived by it.

JP Morgan beyond finance

Although Morgan is best known for his financial influence, his impact reached far beyond banking. He was a passionate art and book collector. His contributions to cultural institutions like the Metropolitan Museum of Art showed a more personal side.

The Morgan Library and Museum in New York, which was once his private collection, now serves the public. His interest in knowledge, literature, and culture made him a figure of influence even outside the world of finance.

Other timeless quotes by JP Morgan

J.P. Morgan had a way with words. His quotes reflect deep insight into human behavior, money, and leadership. Here are a few that continue to inspire:

- “The first step towards getting somewhere is to decide that you are not going to stay where you are.”

- “A man always has two reasons for what he does. A good one and the real one.”

- “Go as far as you can see. When you get there, you’ll be able to see farther.”

- “If you have to ask how much it costs, you can’t afford it.”

- “I don’t want a lawyer to tell me what I cannot do. I hire him to tell me how to do what I want to do.”

- “Millionaires don’t use astrology. Billionaires do.”

These lines, much like the quote of the day by JP Morgan, offer simple words with deep meaning. They show how he thought about power, risk, and planning.

Two key lessons from JP Morgan’s gold quote

- Gold holds value without depending on anyone’s promise. It does not need support from banks or governments. Its worth is in its physical presence.

- Credit is only as strong as trust. If trust breaks, credit collapses. This lesson is especially important today when credit-based systems dominate economies.

Why the quote is still relevant

Today, most money is credit. It is created by banks or governments and accepted because people believe in it. But belief can be shaken by inflation, debt, or policy mistakes. The quote of the day by JP Morgan helps people think critically about financial stability. It reminds us to ask what our money is really worth and whether our systems are built on solid ground.

FAQs

What does the quote of the day by JP Morgan mean?

It means gold has real value while credit depends on trust and future repayment. Gold is stable. Credit is risky.

Why is this quote still important today?

Because it explains the basics of money and helps people understand the risks in credit-based economies.

Who was J.P. Morgan?

He was an American banker who shaped modern finance, saved the economy during crises, and built major industries.

What companies was he involved with?

He helped form United States Steel, General Electric, and supported many railroads and banks.

Is the quote useful for investors?

Yes, it helps investors focus on value and understand the risks tied to borrowed money or overreliance on trust.